Export customs procedures are one of the important factors for goods to be sold abroad. However with innovation in export customs procedures Currently, individuals and organizations are facing difficulties. That's why this article by hbsvietnam.com We will provide detailed instructions on the registration procedures so you can understand better.

Check product policies and tax policies

Table of contents of the article

You need to check product policies and tax policies as soon as possible. If you want to know whether your goods are banned from export or encouraged, you need to look up information in the "List of items subject to export tax" to know more clearly. Besides, you need to find out whether your product is subject to export tax or not. If taxed, how much will be lost? This step must be included in the export customs procedure process.

Figure 1: Check product policies and tax policies when carrying out export customs procedures

Prepare complete documents

To proceed with export customs procedures, you need the following documents:

- Foreign trade contracts

- Commercial invoice

- Packing slips

- The cargo storage agreement includes ship name, trip number, and port of departure.

- The receipt confirms that the container has been landed at the port yard. The information in the slip includes container and seal number.

In case your goods are a specific type of goods, they need to be specialized. That item needs separate documents according to current regulations. For example, exporting wood requires a certificate from the forest ranger at the place of exploitation.

>> See more: Note when preparing rice export procedures

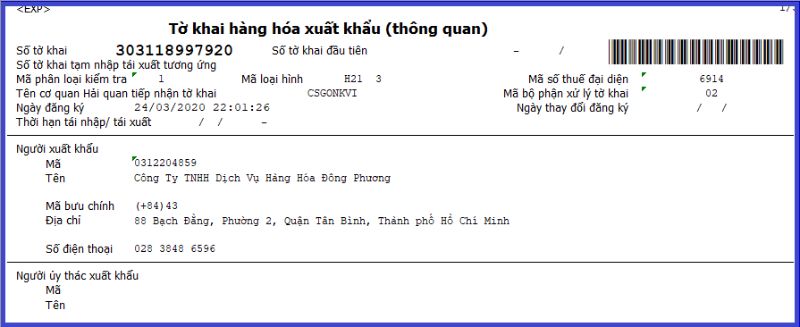

Fill out a detailed and clear customs declaration

The export customs procedure process cannot skip the declaration step. You access the electronic customs software to enter data. If you are new to exporting import For the first time, additional steps must be taken:

- Buy digital signatures and register signatures

- Download and install electronic customs declaration software.

- Proceed to declare shipment information into the software and print the customs declaration.

Figure 2: Access to electronic customs software to declare product code information

Carry out export customs procedures at the customs branch

Export customs procedures are conducted transparently. Export customs procedures at the customs branch are divided into 3 main streams:

- Green channel declaration

You need to go to customs supervision to submit documents such as: drying goods; Barcode sheets are printed from the website of the General Department of Customs or infrastructure fees

- Golden channel declaration

You need to prepare a set of paper documents according to the instructions in Circular 38 including: export customs declaration, commercial invoice. An original copy of the prescribed forest product list if the goods you export are raw wood and the export license from the competent authority. An original copy of the specialized inspection exemption notice or specialized inspection results notice. A photocopy of documents proving eligibility to export goods according to regulations. One copy of the trust contract.

- Red channel declaration

Red channel declaration: When declaring documents, customs will check the actual goods. If the goods are different from those in the declaration but the error is small, the declaration needs to be revised. In case of major errors, you may be subject to administrative fines or not be allowed to export goods

Figure 3: Carrying out export customs procedures at the customs branch before exporting goods

Customs clearance and liquidation of declarations

The final step in export customs procedures is to submit the declaration and barcode sheet to the shipping company with customs supervision. The unit will carry out procedures to confirm actual export with customs supervision when the goods are on board the ship.

>>See more: Refer to the simple calculation of import and export tax in 2022

So, after going through the 5 main steps mentioned above, you will complete it export customs procedures. Hope this information is useful to everyone.